T-Mobile Towers Over Wireless Industry for Streaming TV Ad SOV

T-Mobile has a 20.46% streaming ads SOV so far this year, per iSpot.

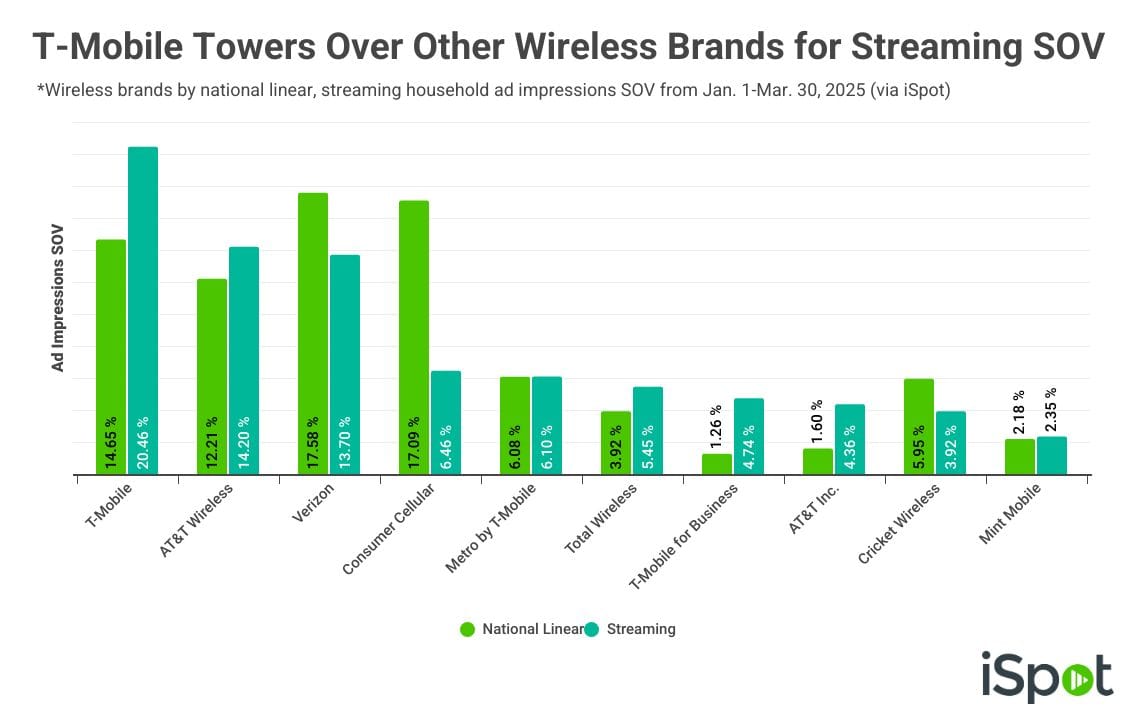

As audiences continue to migrate toward streaming services, many brands, including those in the wireless industry, have adjusted their TV advertising strategy. While linear TV remains a key focus for some including Consumer Cellular and Verizon, others like T-Mobile are jumping ahead on streaming from an ad impressions share of voice standpoint. This varying emphasis on streaming vs. linear may be an indication of different target audiences, and the strategies these brands are employing to reach the right segments of viewers.

iSpot competitive data from Jan. 1 through March 30 shows how some of the top wireless brands are currently measuring up in terms of impressions share of voice (SOV) on streaming vs. national linear TV.

- On linear TV, Verizon and Consumer Cellular are neck and neck for SOV, at 17.58% and 17.09%, respectively.

- While Consumer Cellular is one of the main players on linear, it lags behind on streaming, landing at fourth place with a 6.46% SOV — less than half of No. 3 Verizon’s streaming share.

- Meanwhile, T-Mobile has the biggest footprint on streaming, capturing 20.46% of wireless industry impressions, followed by AT&T Wireless (14.20%) and Verizon (13.70%).

- Two brands that have nearly even SOVs for linear and streaming include Metro by T-Mobile (around 6%) and Mint Mobile (around 2%).