SEC, Big Ten Set To Dominate CFB Viewing Share

This week's newsletter is sponsored by:

This Week On The Measure:

- College Football Audience Consolidation

- Meet Capgemini (VIDEO)

- DNC’s TV Touchdown

- SpongeBob Bubbles Up Big Social Video Watch-Time

- Inclusive Grocery Ads’ Impact

- The Streaming Originals Slowdown

- This Week’s Free Report: Retail’s Purchase Intent Leaders, From iSpot

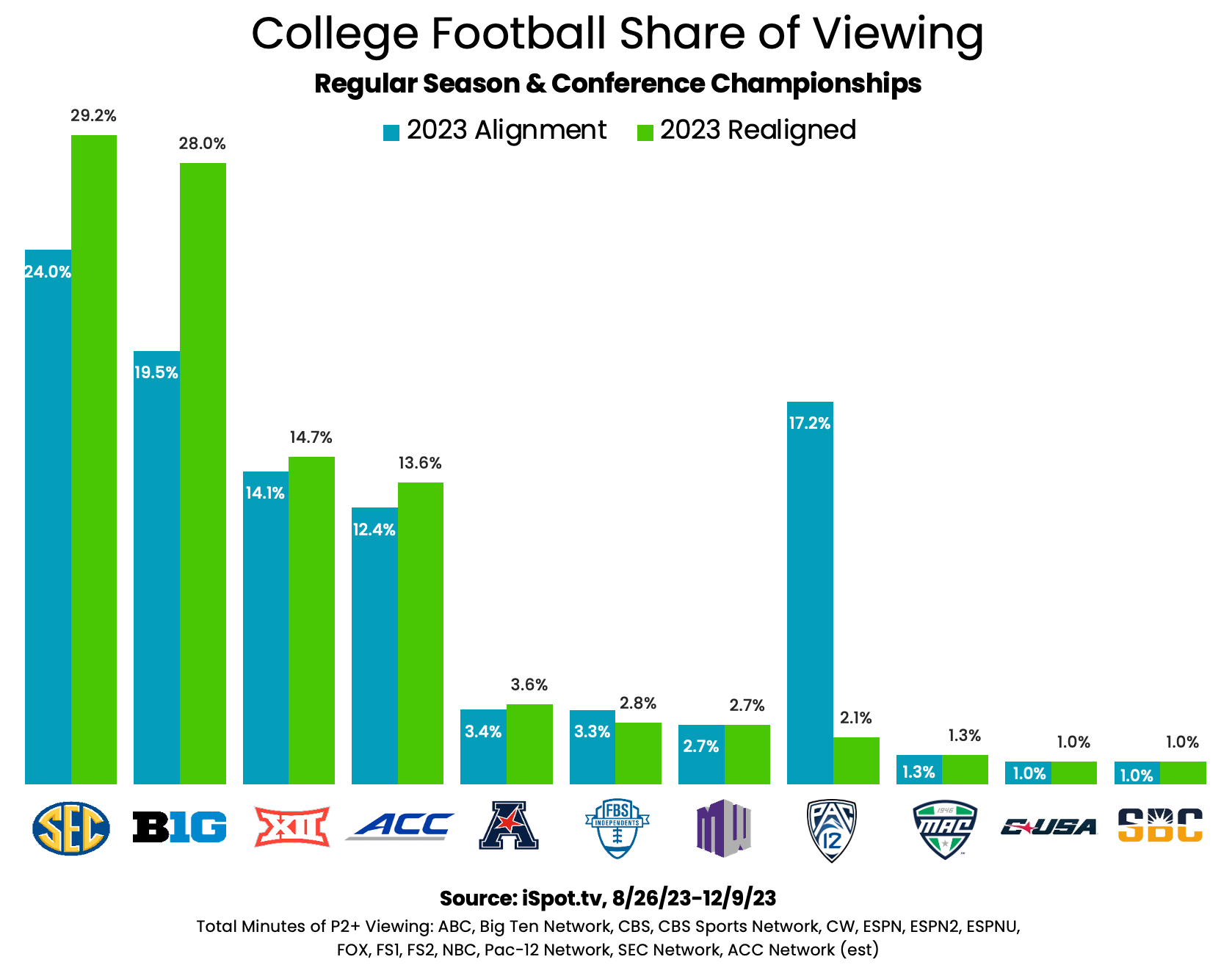

College Football Audience Consolidation

Audience data compiled by iSpot shows that this year’s SEC (with Texas and Oklahoma) and Big Ten (plus Oregon, UCLA, USC and Washington) would’ve combined for 57.2% of the sport’s entire audience last regular season. [READ MORE]

Meet Capgemini’s Amy Alba and Daniel Yogesh Pattappa

Check out our recent conversation with Capgemini’s Amy Alba and Daniel Yogesh Pattappa to dive into what the company does and how it leverages data and technology to help clients. The full conversation is below, filmed in partnership with iSpot.tv and CIMM. [READ MORE]

DNC’s TV Touchdown

Across all networks, the Democratic National Convention captured nearly 5% of all national linear TV minutes watched for the week of Aug. 19-25, according to Inscape. During the week of the RNC in July, that event accounted for 2.96% of watch-time. [READ MORE]

SpongeBob Bubbles Up Big Social Video Watch-Time

Data from Tubular Labs shows that Paramount is celebrating SpongeBob’s 25th birthday with a bang. U.S. social video minutes watched for SpongeBob SquarePants’ official Facebook and YouTube pages grew to 462.2 million in July 2024, a 28% month-over-month climb. [READ MORE]

Inclusive Grocery Ads’ Impact

According to a recent Nielsen study of Revry viewers, 69% of LGBTQ+ consumers are more likely to try a grocery or household item from a brand known for supporting the LGBTQ+ community. [READ MORE]

The Streaming Originals Slowdown

From early 2020 through Q2 2024, global supply of streaming original titles climbed 296%, according to Parrot Analytics. While that indicates aggressive growth, the rate also starts slowing significantly in 2023, before freefalling even more recently. [READ MORE]

This Week’s Free Report: Retail’s Purchase Intent Leaders, From iSpot