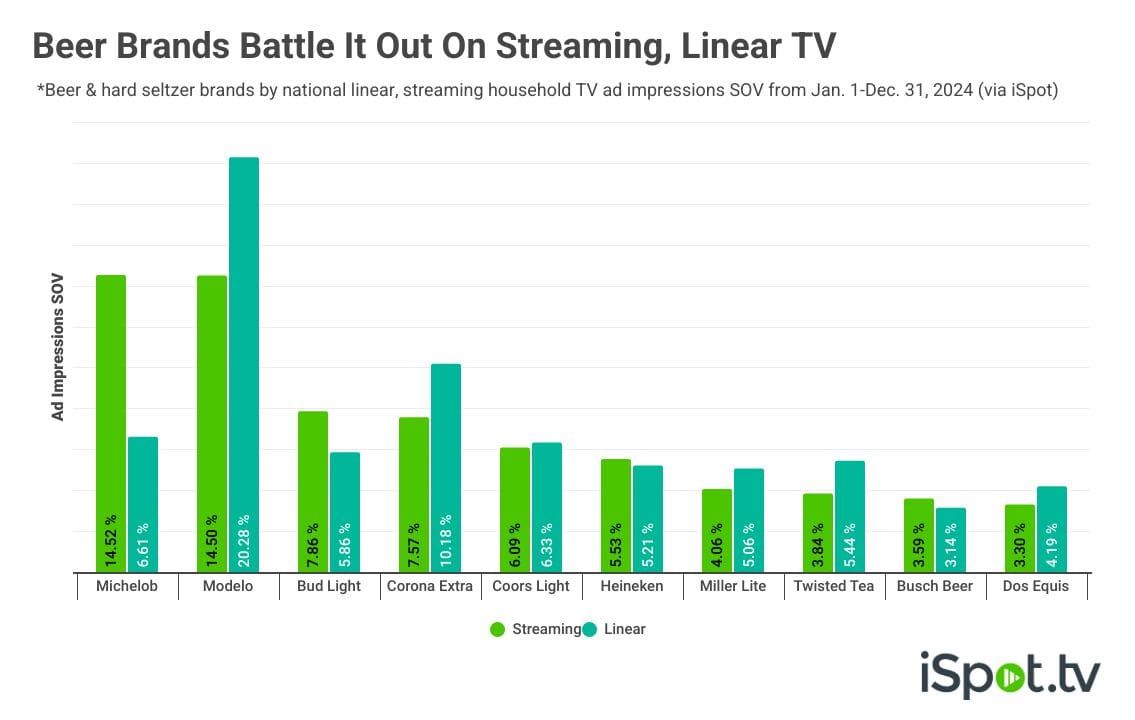

Michelob, Modelo Take Opposite Approaches To Streaming, Linear TV

Beer giants take differing approaches to TV advertising depending on their target audience – and that's no more apparent than when comparing Michelob Ultra and Modelo.

Below, iSpot competitive data shows how Michelob's share of beer TV ad impressions is significantly higher on streaming than it is on linear, while Modelo towers over the competition on linear yet runs neck-and-neck with Michelob on streaming.

- Interestingly, it's ABInBev brands like Michelob (14.5%) and Bud Light (7.9%) that are grabbing a larger share of beer's footprint on streaming relative to their shares on linear (6.6% and 5.9%, respectively).

- But Constellation brands like Modelo (20.3%) and Corona Extra (10.2%) remain more linear-focused, as the two owned the top two spots by share of beer ad impressions on linear TV.

- The difference between the approaches could in part come from where most likely customers have been identified for each beer.

Learn more about iSpot's streaming competitive data and the necessity of a unified approach to TV measurement. Consult with an analyst at The Measure today.