How FASTs Could Grow Regionally With Sports

The following is a selection from Brandon Katz of Parrot Analytics.

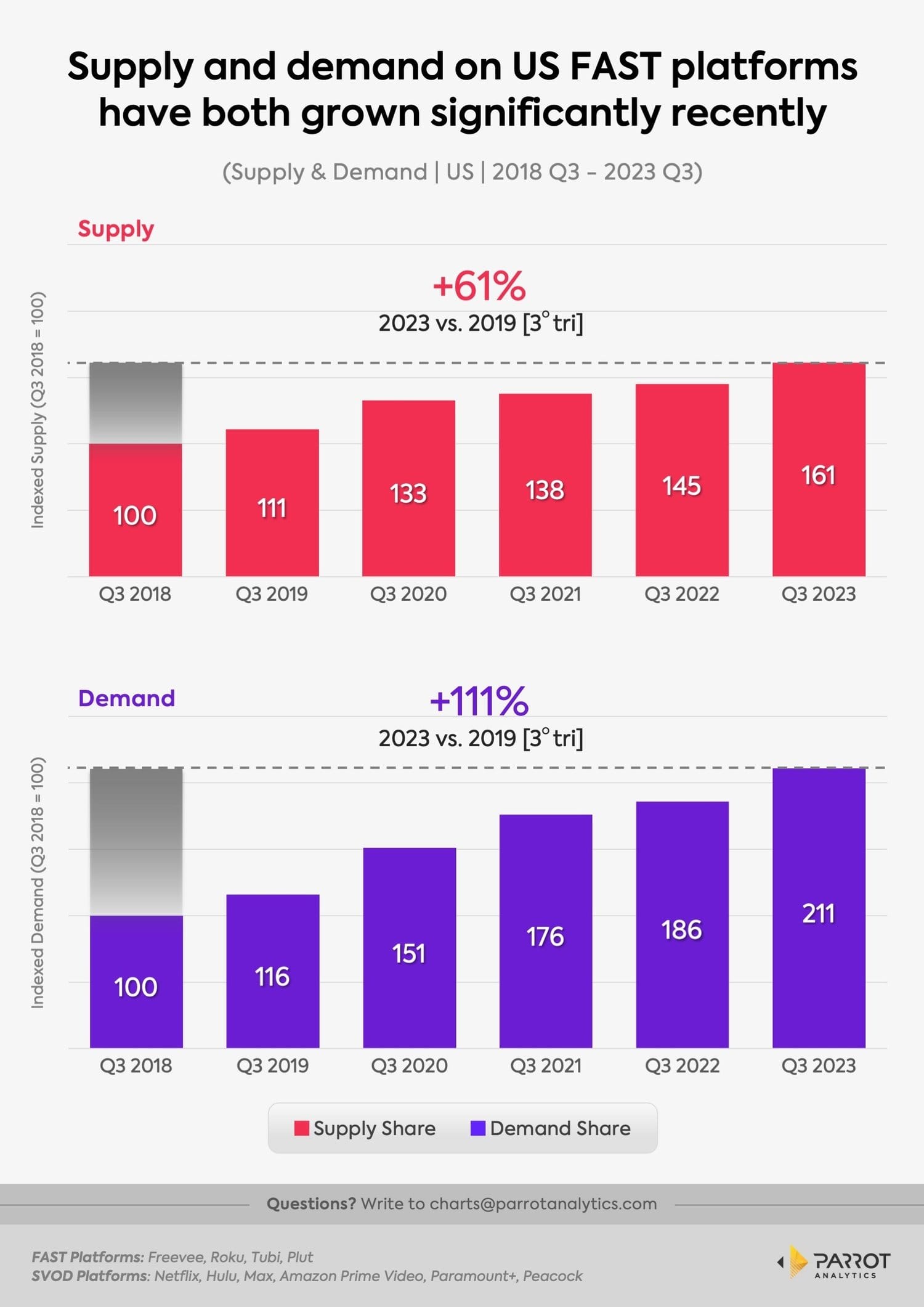

Both supply (+61%) and demand (+111%) for content available on FAST platforms in the U.S. have experienced significant growth from Q3 2018 to Q3 2023, according to Parrot Analytics. Yet despite this growth, mainstream sports seem reluctant to embrace the medium, despite trying to find younger audiences.

- For example: 36% of Tubi’s viewers are in the key younger demo of 18-34, and the service reaches an increasingly multicultural audience with more than 50% growth year-over-year in African American and LGBTQ+ audiences, and 25% in the Hispanic audience, as of 2023.

- FAST is too small to ever disrupt sports’ transition from linear to SVOD streaming. As of 2021, traditional pay TV services earned $69.9B through advertising and another $85B through subscription revenue.

- Compare that with the $2.6 billion in estimated ad revenue generated by all FAST services in the US in 2021 and it’s clear that the medium cannot outright replace the lost revenue from sports that rely on RSNs.

- Even some longer term estimates peg FAST revenue at “only” $12 billion by 2027.

[read the rest of Brandon Katz's post on TVREV]