Data: 50% of Consumers Book via Online Travel Agencies

As part of its 2024 Consumer Insights Report, Wunderkind recently surveyed 1,500 consumers to uncover travel insights, preferences and behaviors driving purchasing decisions.

The travel industry is massive, with the U.S. Travel Association estimating a total economic footprint of $2.8 trillion in 2023. But what are the trends behind the numbers? As part of its 2024 Consumer Insights Report, Wunderkind recently surveyed 1,500 consumers to uncover travel insights, preferences and behaviors driving purchasing decisions.

Some of the top takeaways include:

- 65% of respondents plan to increase or maintain current travel frequency over the next 12 months.

- 50% of consumers say they will book arrangements such as car rentals, hotels or flights through online travel agencies.

- 40% plan to book directly on brand websites, while only 9% will do so through credit card portals.

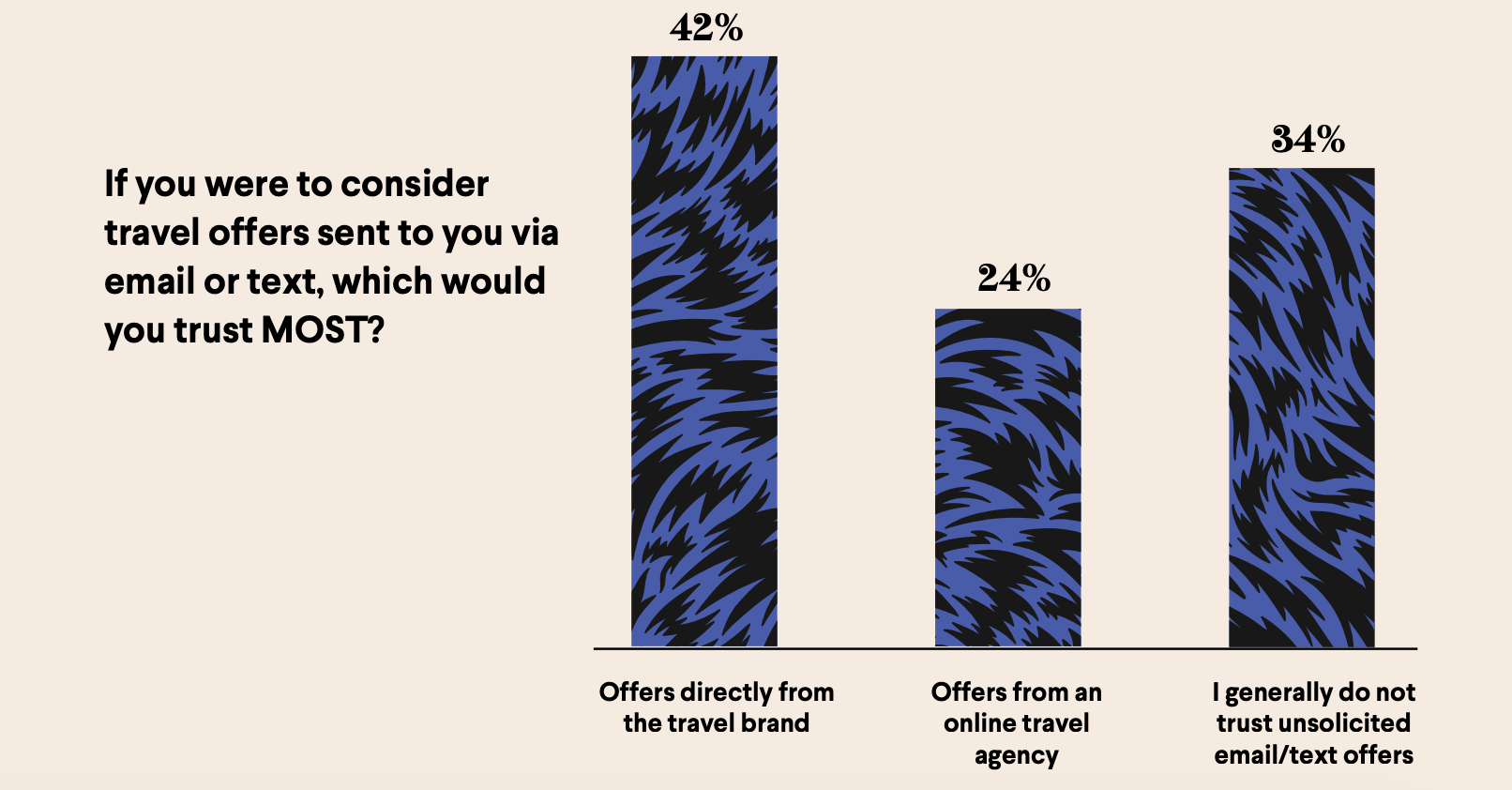

- Although 42% of consumers trust travel brand offers over agencies (24%), most still book through agencies, presenting an opportunity for brands to boost direct bookings and avoid agency fees.

- Consumers are on the look out for discounts and coupon codes — but non-monetary prompts also resonate: 31% of consumers ages 45-54 prefer offers based on previous searches, while 18-24 year olds prefer abandoned cart reminders (26%) and limited availability warnings (28%).

- Consumers utilize a variety of online and offline sources for research including travel agencies (51%), brand websites (39%), online reviews (39%), friends and family (38%), travel publications (22%), travel blogs (18%) and social media (15%).

“The travel industry has a significant opportunity to adopt performance marketing strategies that have been commonplace in retail for years,” said Tim Glomb, VP Digital, Content, and AI at Wunderkind. “Triggered messaging based on browse and search behavior is a massive revenue channel, especially when identity resolution is part of that mix.”