Netflix Wins Overseas Investment War vs. Amazon

The following is a selection from Brandon Katz of Parrot Analytics.

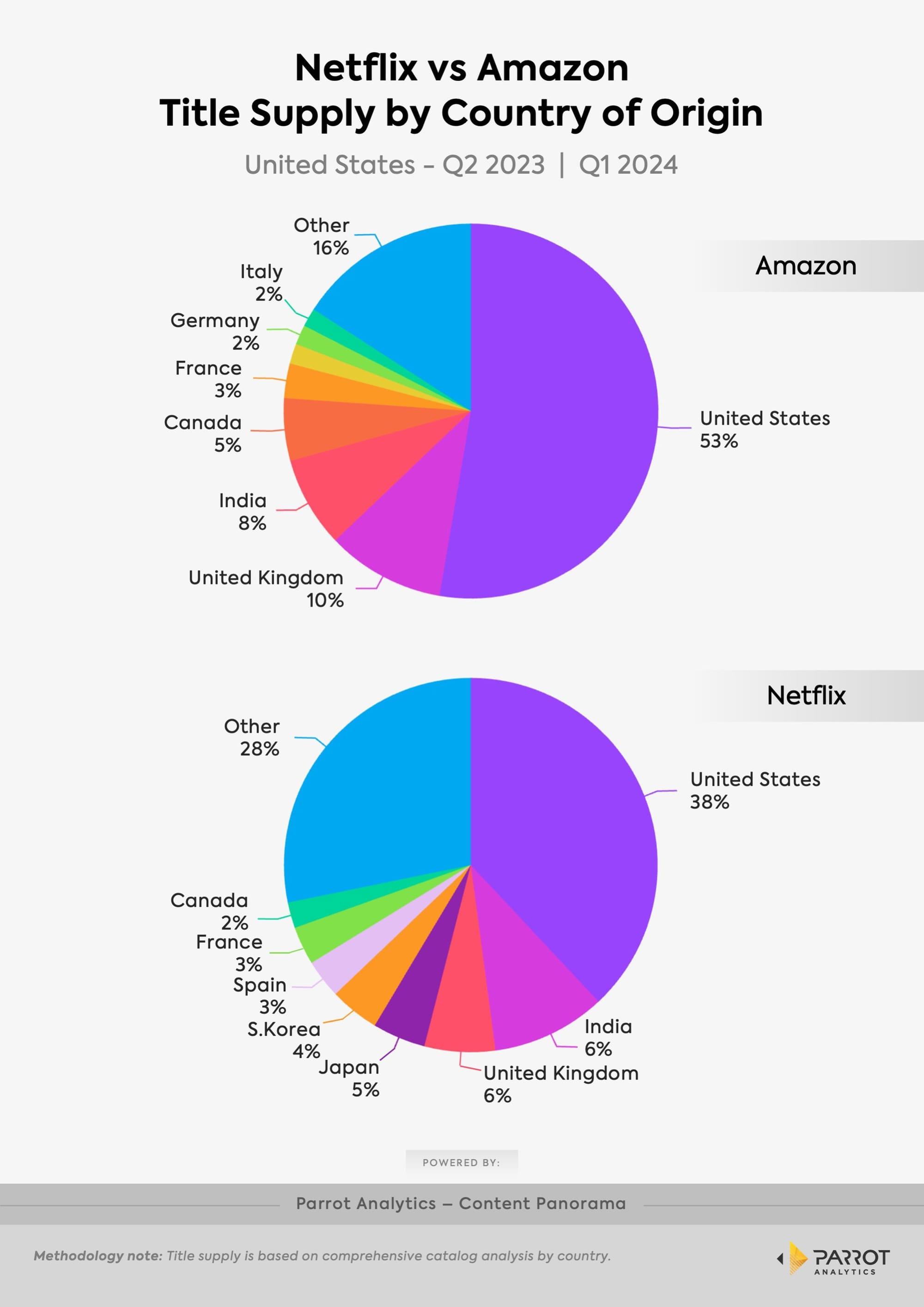

While both Amazon Prime Video and Netflix are both U.S.-based entities and they invest significantly in content for American audiences, both have also been aggressive to expand their reach globally. Data from Parrot Analytics' Content Panorama dive in further:

- 53% of Amazon’s U.S. library over the last four quarters is comprised of titles that originated domestically, vs. 38% for Netflix.

- The five biggest contributors to Amazon’s library after the U.S. in that span are the U.K. (10%), India (8%), Canada (5%), France (3%), and Germany (2%). But for Netflix, it's India (10%), U.K. (6%), Japan (5%), South Korea (4%), and Spain (3%).

- The performance reflects a more efficient use of content resources as overseas production is often less expensive, and also intentionally aligns with Netflix’s growth trends – about 70% of the company’s total subscriber base comes from outside of the U.S. market, while roughly 80% of quarterly subscriber additions are now international.